Dr. Syeda Sehrish Shakir Rizvi

This research investigates Pakistan's taxation system, focusing on its legal framework, policy structure, and the challenges it faces. It also assesses recent tax policy efforts by the government. The study utilizes data from various sources spanning 2008 to 2021, including the Federal Board of Revenue, IMF, Federal Tax Ombudsman, and State Bank of Pakistan. It finds that Pakistan's economy has long encountered significant challenges, but there was improved political stability in the first year of Imran Khan's government. Using an interpretive approach and qualitative methodology, the study suggests that reducing tax rates may expand the tax base, benefiting lower-income populations and potentially increasing net revenue. Overall, this research provides insights into Pakistan's taxation system and its implications.

Keywords: Pakistan Tax problem, Taxation Policy, Economic Development, taxation issues, Pakistan economy.

In many developing countries, including Pakistan, finding significant additional revenue streams can be a challenge (Amjad, 2021). This study aims to analyze the effects of the taxation policies of the PTI government on the economic development of Pakistan, using a concept that offers a broad perspective on policy and examining the effects not only on revenue but also on households in various conditions and on output. The primary objective of tax legislation is to generate revenue for public services while ensuring that the tax burden is distributed fairly among residents using real-world indicators (Wolf, 2021). Pakistan's tax structure, which relies heavily on indirect taxes that are inherently regressive, has sparked passionate discussions about the extent to which the tax burden falls on the poor (Chohan & Akhter, 2021). The federal excise duty, sales tax, income tax, and customs fees are Pakistan's four main sources of tax revenue. However, the goal of tax policy has shifted to simply raising more money to meet unattainable targets for the tax-to-GDP ratio and to reduce the budget deficit. Increasing the tax-to-GDP ratio has become a policy principle, even if it goes against fundamental principles of fairness, transparency, efficiency, and simplicity in taxation (Nasir et al., 2020).

Pakistan experiences an economic shock

The national economy of Pakistan, led by Prime Minister Imran Khan and his Tehreek-e-Insaaf party, is facing numerous challenges such as a growing fiscal deficit, increasing inter-corporate debt in the electricity market, inflation pressures, diminishing exports, and a widening imbalance in current-accounting accounts (Anjum et al., 2021). To stabilize the external sector in the short term, the government has received financial aid from the Gulf and China and is now implementing policies to help the country reach its industrial potential (Ahmed, 2019). The government aims to boost consumer confidence, revive economic growth, and promote sustainable growth taxation policies by enacting supply-side, business- and development-friendly policies, including administrative and tax adjustments for the agricultural and manufacturing sectors (Abd Hakim, 2020). This report provides unique insights into historical trends and offers practical solutions for current research, with a focus on examining the economic impact of PTI's taxation policy.

The COVID-19 outbreak has significantly impacted Pakistan, with a little over 2.1% of individuals who contracted the illness being unwell but not yet dead (Ashfaq & Bashir, 2020). To curb the spread of the disease, the PTI government ordered a total lock-out on March 24, 2020, allowing only essential companies and organizations to operate (Shahryar, 2021). Despite the pandemic leading to a global economic contraction, offshore remittances, which are a vital source of income, grew in Pakistan, even though foreign employees were also laid off in the Gulf and other regions (Shaheen et al., 2020). However, the tourism and hospitality industry has been severely impacted by the pandemic (Wang & Le, 2022).

It is anticipated that the global limiting of economic activity due to COVID-19 will cause a brief increase in global greenhouse gas emission levels once economic activity resumes in the post-COVID-19 period (Deng et al., 2022). This epidemic has significantly impacted economies worldwide and brought about a swift and significant change in people's lives (Janzen& Radulescu, 2022).

Era of PTI Government 2018–2021

The research discusses the political background and achievements of the Pakistani Tehreek-e-Insaf (PTI) party led by Imran Khan (Shaikh & Chen, 2021). The PTI secured a majority of seats in the National Assembly in 2018, and Imran Khan was elected as the 22nd Prime Minister of Pakistan (Raja, 2020). The PTI positioned itself as a "third force" in Pakistan's two-party system. Prime Minister Imran Khan's statements about stabilizing the economy and proclaiming 2020 as the year of growth and wealth creation (Adnan et al., 2021). The Ministry of Finance highlighted several successes in the first five months of FY 2020, including a decrease in the current account deficit, a positive fiscal balance, improved credit scores, and an increase in the country's score on the ease of doing Business Index (Sareen, 2020). The PTI government is credited with increasing exports and reducing the trade imbalance. However, the PTI leadership is being investigated by the National Accountability Bureau over corruption charges. The united opposition has called for accountability, contrasting the PTI's claims of progress in reducing corruption. It is important to note that research reflects a specific perspective and may not encompass all aspects of the PTI government's performance or the political situation in Pakistan (Shaikh & Chen, 2021).

Taxation is a crucial component of plans for economic growth. It is also connected to other policy topics. In order to formalize the economy and promote growth, taxes provide effective government. Taxation gives the government the money it needs to build its infrastructure and creates a favorable climate for business and international commerce (Saqib et al., 2014).

A tax is when a state or a nation's utilitarian equivalent imposes a financial or other charge on a person and makes it illegal for them to refuse to pay. In addition, several subnational entities impose taxes (Hogsden, 2018).

Taxes can be paid in cash or in the work equivalent and can be either direct or indirect. A tax is a "financial burden imposed on individuals or property owners to fund the government." a fee imposed by a legislative body. A tax is defined as "any commitment forced by the government" and "is not an optional payment or donation, but an implemented commitment, demanded pursuant to legislative authority" (Gaertner & Hoopes, 2020).

Taxes are a necessary cost of living in a civilized society and are essential for managing and advancing the economy. Tax is also a fee that the government upholds and imposes on goods, businesses, individuals, and communities. However, because people seldom appreciate taking on this kind of public duty, the characteristic of mandatory levies is often unstable (Ebiringa&Yadirichukwu, 2012).

System of taxation

Indirect taxes, along with surcharges, made up a larger portion of federal and provincial revenue compared to direct taxes. However, relying on indirect taxes often leads to inefficient allocation of resources and puts undue strain on the economy. Direct taxes accounted for 25% of total income in 1949-1950, 33% in 1959-1960, and only 14-17% in the 1970s (Ahmed et al., 2018). Nevertheless, recent attempts have been made to address this issue (Khalid & Nasir, 2020). In the 1990s, fiscal policies aimed to increase direct tax revenues, but only achieved limited success in raising the overall tax-to-GDP ratio. Direct taxes made up 32% of total taxes in the fiscal year 2019-20, but 70% of these taxes were not collected (Rind et al., 2020).

The impact of various taxing systems on economic indicators varies. There are normally two sorts of taxes in the taxation system: direct taxes and indirect taxes. Indirect taxes, including goods and services taxes, have contributed far more than direct taxes like income and company taxes (Abd Hakim, 2020). Over the previous ten years, the annual increase in direct and indirect taxes has not been constant and has varied (Kaka & Ado, 2020).

A person pays direct taxes, such as income tax, transfer tax, property tax, and capital gains tax, directly or indirectly to the government. These direct taxes are dependent on the ability of the person to pay, therefore the more their capacity to pay, the higher the tax (Khalid & Nasir, 2020). For the fiscal year 2020–2021, 36.5 percent of total tax income came from direct taxes. The net collection increased from Rs. 1,523.4 billion in the prior fiscal year to Rs. 1,726 billion, a 13.3% increase. Refunds to claimants were Rs. 91.3 billion in FY 2020–21 as opposed to Rs. 68.6 billion in FY 2019–20 (Khan & Ullah, 2021).

Indirect taxes

The majority of the time, the government imposes and uses indirect taxes to collect taxes. They are essentially taxes that are assessed to taxpayers on an equal basis, regardless of their income (Abomaye-Nimenibo et al., 2018).

Because sales tax also applies to the delivery of goods and services, indirect taxes are well-known. They are indirect taxes if they are assessed as value-added taxes, or VATs, along with the manufacturing process (Abd Hakim, 2020).

Tax-to-GDP Ratio

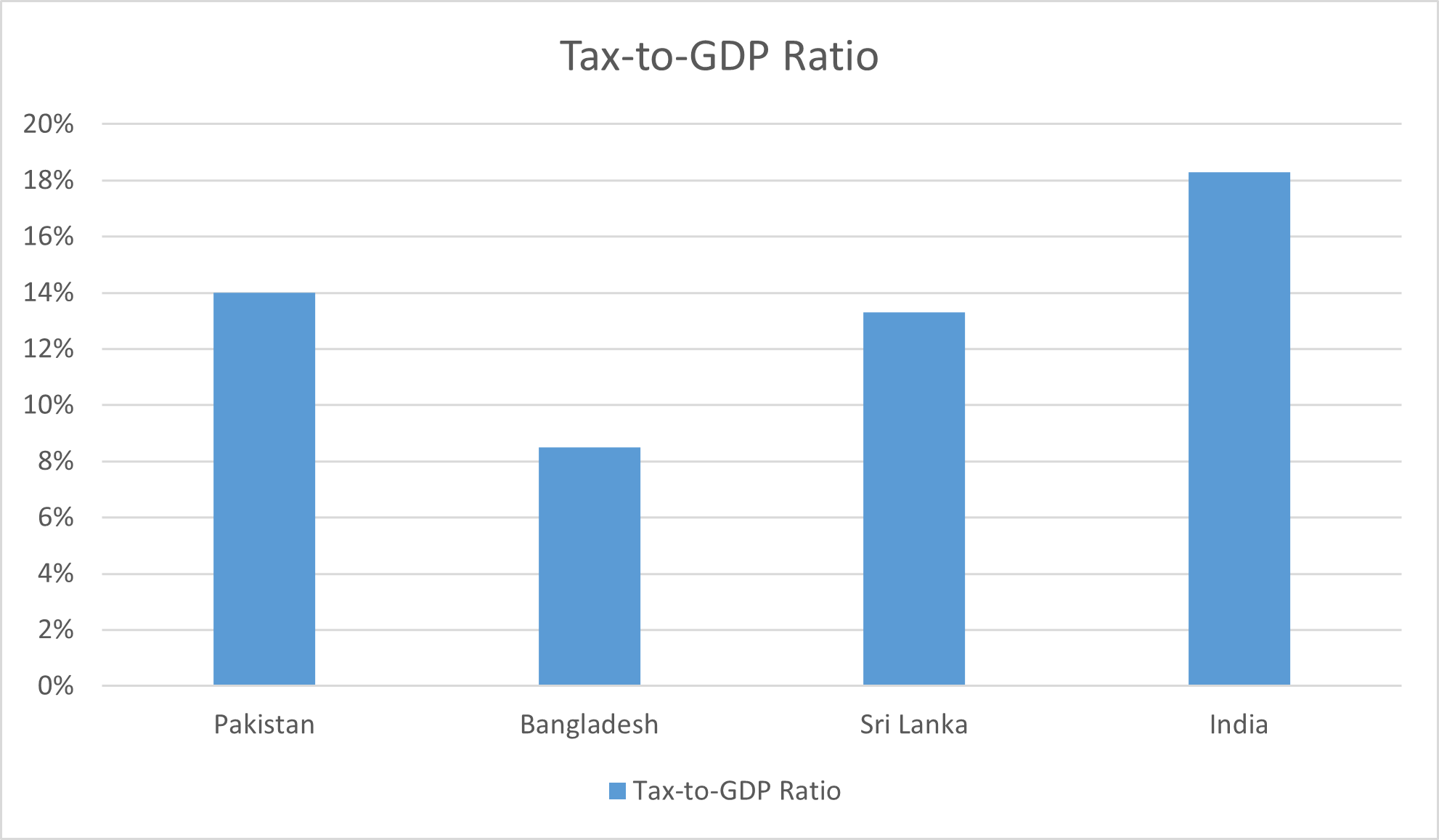

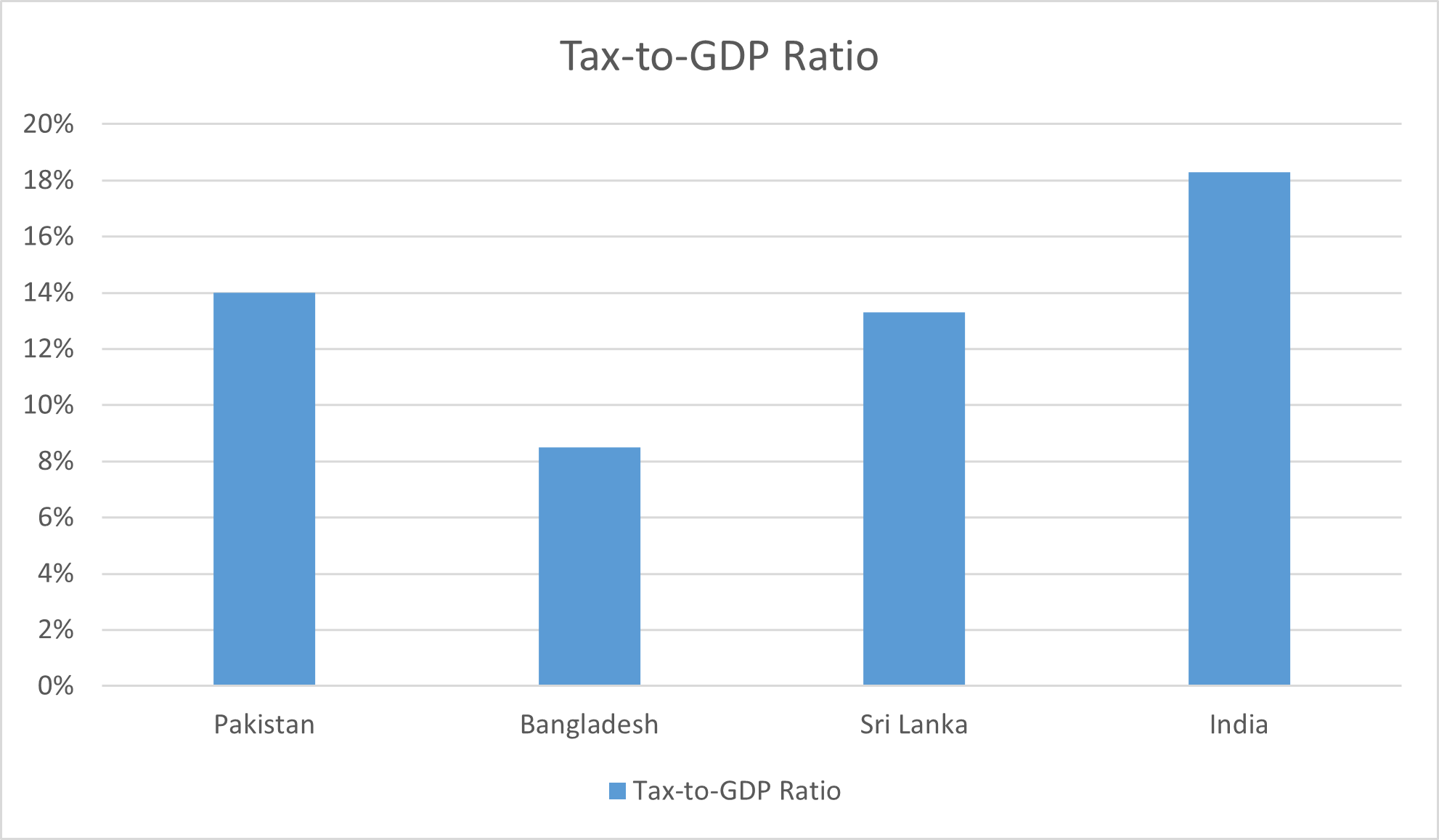

In recent times, it has become increasingly evident that raising the tax-to-GDP ratio is a prudent and sensible policy. However, it is worth noting that there is a dearth of comprehensive research on whether public bond sales have the potential to destabilize the debt-to-GDP ratio and the real interest rate. This issue has assumed greater significance in light of the ongoing public financing crisis triggered by the COVID-19 pandemic (Italo et al., 2022). The government and donors argue that Pakistan's tax-to-GDP ratio is lower compared to other nations. According to research conducted by the International Monetary Fund (IMF), Pakistan's tax-to-GDP ratio of 14% is comparable to that of neighboring countries in the region. For instance, Bangladesh has a ratio of 8.5%, Sri Lanka stands at 13.3%, and India has a ratio of 18.3% (Zia et al., 2021).

Tax-to-GDP Ratio 2020

Structure of Complex Taxation

Pakistan was ranked 161st out of 190 economies in the 2020 Doing Business Report for "paying taxes." This indicator performs poorly due to the complicated tax system and high tax compliance costs. According to the PIDE Report 2020, the number of complaints received by the FTO (Federal Tax Ombudsman) has been increasing over time (Jalil, 2020).

Out of the total cases determined in 2019, 66% of all complaints were accepted. FBR's legislation and rules are included in 34 documents (15 Acts, 11 Ordinances, and 8 Rules), in addition to explanations and notices. Only one document, the Income Tax Ordinance 2001 Amended to December 31, 2019, has 634 pages entirely composed of legalese. This leads companies to retain costly and time-consuming tax accountants and attorneys, which can lead to duplicate accounting and drawn-out rights claim procedures (Haque & Ullah, 2020) return claims are not frequently utilized in Pakistan because of the low return payback ratio and the possibility of being audited if one is submitted. 50–70% of all VAT refund cases are audited, according to the World Bank's Doing Business report for Pakistan (Khalid & Nasir, 2020).

Number of Tax Complaints 2019

|

Category |

Income tax |

Sales tax |

FED |

Custom duty tax |

Total |

|

|

Refund related complaints |

1172 |

381 |

1 |

27 |

1681 |

|

|

Maladministration |

225 |

210 |

6 |

52 |

493 |

|

|

Unnecessary notices |

58 |

18 |

3 |

46 |

125 |

|

|

Others |

125 |

30 |

4 |

52 |

211 |

|

|

Total no. of complaints |

1580 |

639 |

14 |

277 |

2510 |

|

Pakistan’s economy

The Pakistani economy is currently experiencing a period of recovery after a restrictive investment environment and a period of debt-financed "consumption-led" development. In 2018, the intake as a percentage of GDP reached 94.5 percent, which is significantly higher than India's 30% and Bangladesh's 1% (Sarwar et al., 2020). However, the gross total expenditure, including public investment, only accounted for 16.4% of GDP in FY 18. This is considerably lower than the regional average, indicating that Pakistan needs to increase its spending on health and education, which currently stands at 0.7 percent of GDP(Shah & Bukhari, 2019). The government's efforts to meet its goals for human growth and poverty reduction are not surprising given these circumstances. The fiscal budget for this year set by the Pakistan Tehrik-e-Insaf (PTI) government was Rs 7.02 trillion, with a target revenue collection of Rs 5.5 trillion, a 25% increase from the previous year. However, the increase in taxes, particularly the 17% tax on sugar, will primarily burden consumers. Consequently, citizens will face high inflation while their income levels remain relatively stable, leading to a decrease in Pakistan's economic development and a decline in the standard of living for its citizens (Ashfaq & Bashir, 2020). Tax revenues are further reduced by exemptions and preferential treatment granted to executives, which are not disclosed to the public. These exemptions disproportionately affect the cattle, industrial, and utility industries, with producers paying less than 1% of total taxes despite contributing 21% to GDP. In contrast, the development sector, accounting for 13% of GDP, bears 52% of all taxes, while the service sector, representing 58% of GDP, contributes only 37% of tax receipts (Seelkopf & Lierse, 2020). Efforts to improve spending control have resulted in a decrease in the fiscal deficit from 6.6% to 4.6% of GDP in FY 2016. The country is currently undergoing a rebuilding effort, indicating positive signs of development. Policymakers may consider aiming for a significant budget deficit to stimulate the economy while maintaining economic stability, as lower corporate deficits are associated with better economic growth (Shah et al., 2021).

The research strategy chosen for this subjective study is an observational research design that specifically focuses on uncovering the gaps in the Pakistani tax system and ensuring improvements. The study aims to combine applied research, which is widely known to the general public, with practical applications already in place in society to generate original ideas and innovations in the development process. To gain a deeper understanding of the issue, this exploratory research utilizes a qualitative method and interpretative data. The research includes an analysis of recent reports and literature on taxation in Pakistan, such as financial reports from the State Bank of Pakistan, IMF Reports on Taxation Measures in Developing Countries, World Bank reports, and resources from the Federal Board of Revenue (FBR). The study also examines biannual reviews spanning the last ten years of the PPP and PMLN governments, as well as the years of the PTI government. Tabulation and graphical tools are employed in the research to support assertions and clarify ideas. The main objective of this research on tax policy is to understand the legal framework in which policy decisions are made, as well as the motivations behind them in order to achieve specific goals or understand why they may have failed. The development, application, and interpretation of tax laws are of particular interest in the field of legal studies. By considering recent tax adjustments, this study's methodology aims to identify the most effective solutions to the problems within the taxation system.

Agriculture sector

The agriculture industry holds a paramount position in the lives of the majority of individuals, as it serves as a vital source of livelihood for many, both directly and indirectly. Among the various crops cultivated, namely wheat, sugarcane, cotton, and rice, the latter four contribute significantly, accounting for more than 75% of the overall value of agricultural output (Sajid & Rahman, 2021). Pakistan boasts one of the largest irrigation systems globally, enabling the cultivation of approximately one-fourth of its total geographical area. The performance of the agriculture industry in the fiscal year 2020–21 has been generally favorable, with a growth rate of 2.77 percent, slightly below the desired target of 2.8 percent. Notably, both rice and sugarcane production surpassed previous records, with yields of 83.3 and 7.5 million tons, respectively. The Pakistan Bureau of Statistics estimates the value of this sector to be around Rs. 11,542,998 million for the year 2021 (Yaqoob et al., 2021).

The industrial sector in Pakistan plays a crucial role in the country's economy, accounting for a substantial 19.12% of the GDP. Recognizing the importance of this sector, the government has embarked on a path of privatization, aiming to transfer ownership of large-scale industrial facilities to the private sector. This strategic move is driven by the government's desire to support export-oriented sectors and foster diversification within the nation's industrial base, as highlighted by a few researchers in their research findings (Tanveer et al., 2021). Moreover, it is worth noting that small and medium enterprises (SMEs) in Pakistan also make a significant contribution to the overall GDP, with a remarkable 40% yearly share, as reported by researchers in their study, which draws on data from SMEDA (Small and Medium Enterprises Development Authority) and the Economic Survey. This underscores the vital role that SMEs play in bolstering the economic landscape of the country (Abbasi et al., 2021).

Service sector

Pakistan's service sector plays a crucial role in the country's economy, accounting for approximately 61.7% of its GDP. Within this sector, a significant portion, about 24%, is attributed to transportation, storage, communications, finance, and insurance, highlighting their importance in facilitating economic activities. Additionally, wholesale and retail commerce make up around 30% of the service sector, further emphasizing the significance of trade and distribution networks in Pakistan's economic landscape. Recognizing the potential for growth in the information sector and other contemporary service businesses, Pakistan has implemented various incentives, such as long-term tax breaks, to stimulate their development and contribute to overall economic expansion. By fostering an environment conducive to the growth of these sectors, Pakistan aims to enhance its competitiveness in the global market and promote sustainable economic development (Azam et al., 2021).

During the tenure of the PTI-led administration, the performance in terms of Gross National Product (GNP) has been commendable, as it successfully transformed the current account deficit (CAD) into a surplus and attracted a higher influx of remittances from abroad (Nawaz et al., 2021). However, the outbreak of the COVID-19 pandemic had a significant impact on the GDP, causing it to decline from its peak of $313 billion in 2017-18 to $263 billion in 2019-20 under the PTI administration. Nevertheless, there was a notable rebound in GDP growth during the third year of the PTI government, with the GDP reaching $296 billion in 2020-21 (Lakhan et al., 2021). Notably, the domestic tax collection witnessed a remarkable increase compared to the import tax, with sales tax registering a growth of 8.1%, while import FED, WHT, and customs duty experienced negative growth rates (Shafiq et al., 2021). Furthermore, in December 2020, Pakistan's primary export markets, particularly China, witnessed an upswing in their cyclical role, albeit to a lesser extent in other market regions (Munir et al., 2021).

Table 4.1 Comparative analysis

|

Sr. no |

PTI (2018-continue) |

PML-N (2013-2018) |

PPP (2008-2013) |

|

1. |

The agriculture sector increased by 3.81 percent in the year 2020 under the PTI government (Yilmaz & Shakil, 2021). |

A 3.5 percent increase in the agriculture sector in the previous year increased by 2.07 percent in 2017 (Waseem, 2020). |

Agriculture increased at a 3.3 percent annual rate and decreased at the rate of 3.5 percent the previous year 2012 (Burki, 2019). |

|

2. |

PTI government has also reduced the interest rates from 12 percent to 7 percent in two years, however, the pressure is mounting to raise them once again to return to the positive real interest rate (B Sarwar et al., 2020) |

PMLN government also did a good job of lowering the interest rate, which was reduced to 6 percent from 9.5 percent in their five years of government (Shah et al., 2021). |

The PPP had the worst performance in their era; the government had reduced the interest rate from 15 percent to 10 percent in five years of their government (Mehar, 2020). |

|

3. |

According to the Economic Survey 2020-21, the PTI-led government had a per capita income is 1,775 dollars at the end of the fiscal year (Shaikh & Chen, 2021). |

In the fiscal year 2017-18, when PMLN was in power, per capita income was $1651.9 in dollar terms. Per capita, income grew to $1651.9, up from $1629 in the previous fiscal year (Farrukh& Masroor, 2021). |

In 2012-13, the PPP government's per capita income increased by just 4.3 percent. The value of the economy has dropped by Rs600 billion, bringing it to $1,380 (Nasir, 2020). |

|

4. |

The COVID-19 pandemic, which began in early 2020, has had a significant economic impact on the world. In 2020, the global growth was 3.3 percent (Shafiq et al., 2021). |

The global production has increased by 3.8 percent in 2017-18, according to the International Monetary Fund's April 2018 World Economic Outlook report (Sadiq et al., 2021). |

According to the International Monetary Fund's prediction, global economic growth was only 3.3 percent in 2013 and 4.0 percent in the year of 2014 under the PMLN-led government (Shah & Bukhari, 2019). |

|

6. |

By the end of 2019-20, the country's GDP per capita was $1,194 and the annual growth rate decreased by 7.08 percent (Corsi, 2020). |

By the end of 2017-18, the country's GDP per capita was $1,482 and the annual growth rate increased by 1.18 percent (Mughal & Schneider, 2018). |

By the end of 2012-13, the country's GDP per capita was $1,209 and the annual growth rate increased by 0.90 percent (Bashir & Amir, 2019). |

|

7. |

By the fiscal year 2020, Pakistan's GDP had grown at the rate of 3.94 percent (Khan & Ahmed, 2020). |

The real GDP of Pakistan stood at 5.53 percent in the year of 2018 under the PMLN government (Abbasi et al., 2021). |

In the fiscal year of 2013, the real GDP was 4.99 percent (Abbasi et al., 2021). |

|

8. |

In FY 2021, the Industrial sector grew by 3.6 percent (Younis et al., 2021). |

The average industrial sector growth was 5.13 percent in the five years of the PMLN government (Noman et al., 2021). |

During the tenure of the PPP government, the annual industrial sector growth was 1.2 percent (Shair et al., 2021). |

|

9. |

The Services sector grew by 4.4 percent in FY2021 (Asma et al., 2021). |

The average rate of growth in the service sector grew by 5.9 percent during the PML-N-led government (Sadiq et al., 2021). |

The average rate of growth in the service sector grew by 3.6 percent under the PPP (Ullah et al., 2021). |

|

10. |

The budget deficit was reduced to 3.5 percent of the GDP in FY2021, compared to 4.1 percent the previous year (Cheema & Baloch, 2021). |

The fiscal sector performed well in the first half of the current fiscal year, with robust income growth relative to the expenditures helping to keep the fiscal deficit to 2.3 percent of GDP, down from 2.5 percent at the same time last year 2017 (Rais et al., 2021). |

The fiscal deficit in the first nine months of 2012-13 was 4.6 percent of the GDP, compared to 6.4 percent of the GDP (Munir & Perveen, 2021). |

Table No. 3 shows that the Pakistan People's Party's (PPP) performance was below average. However, the claim that the situation was so dire that drastic measures were necessary is based on exaggerated and biased data. Some people believe that the PPP hurt Pakistan's economy (Burki, 2019).

As the Pakistan Muslim League-Nawaz (PML-N) government's term comes to an end, its overall record paints a somewhat negative picture despite high hopes for an economic turnaround in Pakistan (Shah et al., 2021).

The Pakistan Tehreek-e-Insaf (PTI) government's three-year term has also come to a close. Discussions on the country's economic success are heavily influenced by politics and the selective use of evidence. If you ask about inflation, most people will say that it has been on the rise. However, if you're curious about the government's management of the current account, the answer is that it has been quite successful (Khan & Ahmed, 2020).

Finding

According to research, indirect charges make up a significant portion of government and civil tax policies, making it difficult to eliminate them, particularly when the government is grappling with a serious debt and balance of payments problem. To improve economic efficiency in the long run, it is important to continuously reduce the proportion of indirect charges as the tax base is expanded. The tax system inherited by the current government was complicated by administrative issues and loopholes. As part of its campaign strategy, the administration appropriately introduced and implemented tax reforms. From July to March of FY2020, the administration successfully reduced the budget deficit from 5.1 percent of GDP the previous year to 4.0 percent of GDP. The primary balance also showed a surplus of Rs 194 billion between July and March of FY2020, as opposed to a deficit of Rs 463 billion. However, the COVID-19 outbreak has changed the near-term situation. The government is now considering several new measures to lessen the financial impact of COVID-19, in addition to increasing public health spending and improving social safety net programs. Consequently, the budget will deviate from its primary objective in the short term. It will be difficult to meet revenue estimates in both the tax and non-tax sectors due to the disruption in economic activity. Thus, it is expected that the budget deficit will exceed the target for FY2020.

The study's findings demonstrate that taxes have a less-than-optimal distributional effect since there is more regressive taxation than is ideal in our current circumstances. The primary goal of the PTI administration should be to rebalance the present tax structure in a way that minimizes the financial burden on the average man while also boosting the social welfare component. As a result, contrary to popular belief, the findings are consistent with the idea that higher tax rates reduce revenue collection. The results show that Pakistan's tax system is intrinsically unbalanced because of its complex levies, making optimal collection impossible. These changes compelled the judicial system to work harder and more effectively to collect taxes. Compared to previous administrations led by the Pakistan Peoples' Party (PPP) and the Pakistan Muslim League-Nawaz (PML-N), the Pakistan Tehreek-e-Insaf (PTI) administration has done significantly better. The country's economy has improved and been reinforced as a result of the present administration's sensible economic measures. The economic numbers indicated that although the coronavirus pandemic had a substantial impact on the country's economy, things were now improving. The PTI administration has actively worked to help farmers by bolstering the agriculture industry, especially by providing fertilizer and seed subsidies.

For the government, things were challenging because of a worsening trade imbalance, diminishing foreign reserves, and rising unemployment. Short-term and long-term economic measures are necessary to strengthen the business climate. To achieve this, national vocational and technical training facilities should be established to improve worker skill levels. Additionally, the economy should pursue foreign direct investments that are motivated by efficiency to advance the industrialization process.

According to the research, tax changes are worth 42.5 percent less than PTI commitments. How well the PTI administration can increase its income base will be key. They have set high standards for themselves and have enlisted the help of a private sector tax specialist to help them achieve them. The only way to increase income in the short term is to reduce the size of the present tax base. The Federal Board of Revenue Chairman Shabbar Zaidi's tax revisions will determine the government's medium-term economic prospects.

Before the publication of the next budget, we should prepare for an economic slowdown that will result in greater inflation and a tighter job market. Reduced income taxes would be able to stem part of this inflation, but Pakistan needs to increase tax collections as quickly as possible, so that is not the case. Meeting the high-income predictions may be difficult with less than 1% of the 208 million individuals filling out applications.

Abbasi, K. R., Abbas, J., & Tufail, M. (2021). Revisiting electricity consumption, price, and real GDP: A modified sectoral level analysis from Pakistan. Energy Policy, 149, 112087.

Abd Hakim, T. (2020). Direct versus indirect taxes: Impact on economic growth and total tax revenue. International Journal of Financial Research, 11(2), 146-153.

Abomaye-Nimenibo, W. A. S., Michael, J. E., & Friday, H. C. (2018). An empirical analysis of tax revenue and economic growth in Nigeria from 1980 to 2015. Global Journal of Human-Social Science, 18(3), 8-33.

Adnan, S., Hanif, M., Khan, A. H., Latif, M., Ullah, K., Bashir, F., ...& Haider, S. (2021). Impact of heat index and ultraviolet index on COVID-19 in major cities of Pakistan. Journal of occupational and environmental medicine, 63(2), 98.

Ahmed, M. A. (2019). Pakistan: Economy under Elites–Tax Amnesty Schemes, 2018. Asian Journal of Law and Economics, 10(2).

Ahmed, M. A. (2020). Pakistan: Withholdingization of the Economic System-A Source of Revenue, Civil Strife, or Dutch Disease+? Civil Strife, or Dutch Disease.

Ahmed, R. R., Ghauri, S. P., Vveinhardt, J., &Streimikiene, D. (2018). An empirical analysis of export, import, and inflation: a case of Pakistan. ESPERA, 21(3).

Amjad, M. (2021). Tax Policy in Pakistan: Concerns and Reforms. Available at SSRN 3791148.

Anjum, M. S., Ali, S. M., Subhani, M. A., Anwar, M. N., Nizami, A. S., Ashraf, U., & Khokhar, M. F. (2021). An emerged challenge of air pollution and ever-increasing particulate matter in Pakistan; a critical review. Journal of Hazardous Materials, 402, 123943.

Anwar, U., Nawaz, A. R., Raza, M. A., Nasar, A., & Ahmad, I. (2021). Role of Private Investment in Economic Growth in Pakistan: A Time Series Analysis (1980-2017).

Ashfaq, M., & Bashir, M. (2020). Pakistan: making a “COVID budget” in a struggling economy. Journal of Public Budgeting, Accounting & Financial Management.

Asma, M., Rahim, F. U., & Shaikh, A. I. (2021). Political Economy of PTI Governance: Manifesto, Performance, Achievements and Challenges. ASIAN Journal of International Peace & Security (AJIPS), 5(1), 25-33.

Azam, M., Nawaz, S., Rafiq, Z., & Iqbal, N. (2021). A spatial-temporal decomposition of carbon emission intensity: a sectoral level analysis in Pakistan. Environmental Science and Pollution Research, 28(17), 21381-21395.

Bashir, A., & Amir, A. (2019). Relationship between Government Expenditure on Education and GDP Per Capita in Pakistan: An ARDL Approach to Co-integration. Advances and Applications in Statistics, 55(1), 77-103.

Burki, S. J. (2019). The Pakistan story. In Pakistan at Seventy (pp. 23-37). Routledge.

Butt, M. D., & Ahmed, M. (2019). Testing for Multiple Bubbles in Inflation for Pakistan.

Cheema, A. U., & Baloch, H. (2021). A Quantitative Analysis of Language Crisis and National Identity in Naya Pakistan. Journal of Indian Studies, 7(1), 43-68.

Chohan, S. R., & Akhter, Z. H. (2021). Electronic government services value creation from artificial intelligence: AI-based e-government services for Pakistan. Electronic Government, an International Journal, 17(3), 374-390.

Corsi, M. (2020). Pakistan 2020: The PTI government amidst COVID-19 pandemic. Asia Maior, 31.

Deng, Q. S., Alvarado, R., Cuesta, L., Tillaguango, B., Murshed, M., Rehman, A., ... & López-Sánchez, M. (2022). Asymmetric impacts of foreign direct investment inflows, financial development, and social globalization on environmental pollution. Economic Analysis and Policy.

Ebiringa, O. T., & Yadirichukwu, E. (2012). Analysis of tax formation and impact on economic growth in Nigeria. International Journal of Accounting and Financial Reporting, 2(2), 367.

Farrukh, F., & Masroor, F. (2021). Portrayal of power in manifestos: Investigating authority legitimation strategies of Pakistan’s political parties. Journal of Language and Politics, 20(3), 451-473.

Gaertner, F. B., Hoopes, J. L., & Williams, B. M. (2020). Making only America great? Non-US market reactions to US tax reform. Management Science, 66(2), 687-697.

Haque, N. U., & Ullah, R. R. (2020). Estimating the Footprint of Government on the Economy (No. 2020: 26). Pakistan Institute of Development Economics.

Hogsden, J. (2018). The Contemporary Corporate Tax Strategy Environment. In Contemporary Issues in Accounting (pp. 85-104). Palgrave Macmillan, Cham.

Italo, B. G., Germana, G., & Giuseppe, T. (2022). Monetary and fiscal policy in a nonlinear model of public debt. Economic Analysis and Policy.

JALIL, A. (2020). PIDE KNOWLEDGE BRIEF.

Janzen, B., & Radulescu, D. (2022). Effects of COVID-19 related government response stringency and support policies: Evidence from European firms. Economic analysis and policy, 76, 129-145.

Kaka, E. J., & Ado, A. B. (2020). An investigation of the link between indirect tax, oil receipt, debt on foreign reserves in Nigeria. Journal of Contemporary Accounting, 119-128.

Khalid, M., & Nasir, M. (2020). Tax Structure in Pakistan: Fragmented, Exploitative and Anti-growth. The Pakistan Development Review, 59(3), 461-468.

Khan, K. M., & Ullah, N. (2021). Post COVID-19 financial distress in Pakistan: Prediction of corporate defaults at Pakistan Stock Exchange. Liberal Arts and Social Sciences International Journal (LASSIJ), 5(1), 386-400.

Khan, M. M., & Ahmad, R. (2020). Combating corruption through institutional reforms to strengthen economy and governance: evidence from Pakistan. Global Economics Review, 5(1), 38-49.

Lakhan, G. R., Kalwar, M. S., Channa, A., Barkat, N., & Soomro, B. A. (2021). Pakistan’s economy: A sign of a blossoming recovery. Turkish Journal of Physiotherapy and Rehabilitation, 8635-8645.

Mehar, M. A. (2020). Infrastructure development and public-private partnership: Measuring impacts of urban transport infrastructure in Pakistan.

Mughal, K., & Schneider, F. (2018). Shadow economy in Pakistan: Its size and interaction with official economy.

Munir, F., Ishaq, M. A., Khalid, S., & Ali, H. (2021). Depreciation of Pak Rupee and Its Effects on Tax Collection by FBR. Review of Economics and Development Studies, 7(1), 63-76.

Munir, K., & Perveen, A. (2021). Impact of Total, Internal and External Government Debt on Interest Rate in Pakistan. Journal of Applied Economics & Business Research, 11(1).

Nasir, M., Faraz, N., & Anwar, S. (2020). Doing taxes better: Simplify, open and grow economy. The Pakistan Development Review, 59(1), 129-137.

Nawaz, H., Barbra, N., & Hassan, N. (2021). The Impact of COVID-19 on Pakistan’s Export Oriented Economic Growth. Economics and Business Quarterly Reviews, 4(3).

Noman, M., Mujahid, N., & Fatima, A. The Assessment of Occupational Injuries of Workers (OIW) in Pakistan.

Rais, M. U. N., Mangan, T., Sahito, J. G. M., & Qureshi, N. A. (2021). A trend analysis: Forecasting growth performance of production and export of chilli in Pakistan. Sarhad Journal of Agriculture, 37(1), 220-225.

Raja, R. (2020). The Principles of the Flourishing Community: A Case Study of the Persecuted Ahmadiyya Muslim Community. international journal on minority and group rights, 27(4), 765-795.

Rind, Z. K., Talpur, U., Sheikh, P. A., & Jamali, T. (2020). An Analytical Review of Pakistan’s Foreign Trade. International Research Journal of Management and Social Sciences, 1(1), 64-77.

Sadiq, M., Usman, M., Zamir, A., Shabbir, M. S., & Arif, A. (2021). Nexus between economic growth and foreign private investment: evidence from Pakistan economy. Cogent Economics & Finance, 9(1), 1956067.

Sajid, M. J., & Rahman, M. H. U. (2021). The nexus between environmental impact and agricultural sector linkages: a case study of Pakistan. Atmosphere, 12(9), 1200.

Saqib, S., Ali, T., Riaz, M. F., Anwar, S., & Aslam, A. (2014). Taxation effects on economic activity in Pakistan. Journal of Finance and Economics, 2(6), 215-219.

Sareen, S. (2020). COVID-19 and Pakistan: The economic fallout. ORF Occasional Paper, (251), 50.

SARWAR, B., MUHAMMAD, N., & ZAMAN, N. U. (2020). Diversification, industry concentration, and bank margins: Empirical evidence from an emerging south Asian economy. The Journal of Asian Finance, Economics and Business, 7(7), 349-360.

Seelkopf, L., & Lierse, H. (2020). Democracy and the global spread of progressive taxes. Global Social Policy, 20(2), 165-191.

Shafiq, M. N., Hua, L., Bhatti, M. A., & Gillani, S. (2021). Impact of Taxation on Foreign Direct Investment: Empirical Evidence from Pakistan. Pakistan Journal of Humanities and Social Sciences, 9(1), 10-18.

Shah, S. R. A., & Bukhari, S. M. H. (2019). Policy Making, Theories and Practices: A Study of Pakistan. Policy, 9(3).

Shah, Y. F., Aslam, M. A., & Mustafa, G. (2021). A STRATEGIC PUZZLE OF SAUDI-IRAN STRIFE AND FOREIGN POLICY CHOICES OF PAKISTAN (2013-18). Gomal University Journal of Research, 37(2), 195-207.

Shaheen, M., Siraj, U., & Bhatti, M. N. (2020). Covid-19 Pandemic and its Politico-Economic Implications: A Study of Pakistan. Liberal Arts and Social Sciences International Journal (LASSIJ), 4(2), 42-51.

Shahryar, B. (2021). Tax Amnesties in Tax Reform Policy: A Case Study from Pakistan and Lessons for Developing Economies. Asian Journal of Law and Economics, 12(1), 37-71.

Shaikh, R., & Chen, C. K. (2021). China’s Debt Trap in Pakistan? A Case Study of the CPEC Project. South Asia Research, 41(3), 399-414.

Shair, F., Shaorong, S., Kamran, H. W., Hussain, M. S., Nawaz, M. A., & Nguyen, V. C. (2021). Assessing the efficiency and total factor productivity growth of the banking industry: do environmental concerns matter? Environmental Science and Pollution Research, 28(16), 20822-20838.

Tanveer, A., Song, H., Faheem, M., Daud, A., & Naseer, S. (2021). Unveiling the asymmetric impact of energy consumption on environmental mitigation in the manufacturing sector of Pakistan. Environmental Science and Pollution Research, 28(45), 64586-64605.

Ullah, H., Wang, Z., Abbas, M. G., Zhang, F., SHAHZAD, U., & MAHMOOD, M. R. (2021). Association of financial distress and predicted bankruptcy: The case of Pakistani banking sector. The Journal of Asian Finance, Economics and Business, 8(1), 573-585.

Wang, Z., & Le, T. T. (2022). The COVID-19 pandemic’s effects on SMEs and travel agencies:

Waseem, M. (2020). Does Cutting the Tax Rate to Zero Induce Behavior Different from Other Tax Cuts? Evidence from Pakistan. Review of Economics and Statistics, 102(3), 426-441.

Wolf, S. O. (2021). China-Pakistan Economic Corridor of the Belt and Road Initiative. Springer.

Yaqoob, H., Teoh, Y. H., Sher, F., Ashraf, M. U., Amjad, S., Jamil, M. A., ...& Mujtaba, M. A. (2021). Jatropha Curcas biodiesel: A lucrative recipe for Pakistan’s energy sector. Processes, 9(7), 1129.

Yilmaz, I., & Shakil, K. (2021). Pakistan Tehreek-e-Insaf: Pakistan’s Iconic Populist Movement. ECPS. Available online: https://www. populismstudies.org/pakistan-tehreek-e-insaf-pakistans-iconic-populist-movement/(accessed on 7 May 2021).

Younis, M., Shah, N. H., Gul, R., Khan, H., & Malik, R. (2021). IMPACT OF CHANGE OF GOVERNMENT IN PAKISTAN ON CPEC AND PAK-CHINA RELATIONS. PalArch's Journal of Archaeology of Egypt/Egyptology, 18(10), 3054-3067.

Zia, M. A., Abbas, R. Z., &Arshed, N. (2021). Money laundering and terror financing: issues and challenges in Pakistan. Journal of Money Laundering Control.